Explaining Escrow: Understanding the Basics of Mortgage Escrow Accounts

What Is Escrow?

When talking about escrow and how it relates to mortgages, there are two related but technically different terms: escrow and an escrow account.

An escrow account, at its most simple, is a type of financial savings account. Escrow itself, on the other hand, is the process by which the escrow account is used.

Throughout the mortgage process, you will likely encounter escrow more than once, and the specifics of how it will work in each situation varies.

However, before we dive into those differences, this short video covers the basics of what escrow is, the main way you'll encounter it with a mortgage, and a brief overview of how the process works.

Escrow before Closing

The first time you'll encounter escrow during the homebuying process will likely be before closing. When you make an offer on a home, your agent may encourage you to include earnest money as part of the offer, which is where escrow comes in.

When you put down an earnest money deposit, it gets held in escrow by a third party who doesn't represent either your interests or the interests of the seller. Because they won't gain anything by the transaction, your money is safe until a decision is made about your offer.

In this situation, escrow protects you in case the seller doesn't pick your offer. If you were to give it straight to them, it could be harder to get it back if they choose to go with someone else.

However, if your offer gets accepted, the earnest money will be taken out of escrow and applied to your down payment. If it's rejected, you'll simply get the money back, minus a small cancellation fee.

Escrow after Closing

How escrow works is a little bit different after closing on a home.

Instead of a one-time deposit covering earnest money, you'll make monthly deposits as part of your mortgage payment. These deposits will then be used for your property taxes and homeowners insurance premium each time they're due.

Because of how the payment is structured, many homeowners believe that their mortgage payment is a singular lump sum, and they don't even realize they're putting money into an escrow account. However, that monthly mortgage payment is actually comprised of four separate costs:

- Principal

- Interest

- Property taxes

- Homeowners insurance

Though you pay just one amount, only the first two parts (principal and interest) go to your lender, while the second two parts (taxes and insurance) get held in your escrow account until they're due.

The Benefits of an Escrow Account

Most lenders usually require homebuyers—especially those who are either buying for the first time or aren't making a large deposit—to set up an escrow account as a condition of their loan. This makes things easier while also protecting both you and the lender from a variety of issues.

Easier Budgeting

One of the most surprising parts of buying a home is all of the additional costs associated with it. Some of the largest expenses you have to deal with after buying your home are your property taxes and homeowners insurance.

Often these charges are multiple thousands of dollars each, and they come due just once or twice a year for most homeowners.

With all that time in between payments, it's easy to forget about it until the bill comes and suddenly thousands of dollars are all due at once. However, when you make regular escrow payments into a dedicated account, it's much easier to make sure you'll have the money when the time comes.

Or, to put it more accurately, your lender has access to the money and they can pay the bill on your behalf.

Avoiding Late Payments & Foreclosure

When your lender is in charge of your escrow account, you don't have to worry about forgetting your tax and insurance due dates. It's their responsibility to remember, and they'll do a good job of it because of how much can go wrong if they don't.

But if you don't have an escrow account, the consequences of making a late payment can have a huge impact on your personal finances.

For starters, there are the late fees. Then, in addition to these (often) multi-thousand dollar penalties, your home could also eventually go into foreclosure. Even if you've been making your mortgage payment on time, not paying your taxes is usually considered a default on your loan agreement.

If you want to avoid any chance of these problems, then an escrow account is the way to go.

Protecting Your Home

One reason lenders are so concerned about making sure your property taxes get paid is that if they're not, the government can place a lien on your property.

This lien takes precedence over what you owe to your lender, so until it gets resolved, your lender could miss out on recouping the money you owe them.

In addition, if you miss an insurance payment, you could lose coverage. If anything were to happen to your home, and you default on your loan, your lender is out the money you owed because they don't even have the home itself to try and recover what they lent you.

Because a lender doesn't want to lose out on money in either situation, they'll be highly motivated to remember your payments. It's why so many of them make an escrow account a required part of your loan terms.

But as the previous section explains, this system also ends up helping you. You don't have to worry about losing your home because of a lien or from not having insurance to repair damages.

Problems with Escrow Accounts

Even though escrow accounts are extremely beneficial overall, there are some concerns you should be aware of and potential problems you might encounter.

Account Fees

One of the first cons of an escrow account are the additional fees they require. These account fees are usually paid at closing, increasing the amount of money you'd have to bring to the table.

While the fees sound relatively small—typically 1–2% of the home's price—it's still additional money coming out of your pocket. On a $234,900 home (the median home price as of 5/31/19), these fees would range from $2,349 to $4,698.

However, the good news is this may not all need to come out of your pocket. You could always try to negotiate with the seller to see if they'd be willing to pay this closing cost. Or, at the very least, they may be willing to split it with you.

Shortages

Potentially one of the most difficult problems you might encounter, a shortage in your escrow account occurs when the amount you owe is more than what you've been paying into your account.

Shortages can happen because your lender estimates each year's property taxes based on what they were before. However, a lot of factors can change in one year that could lead to an increase, and neither you nor your lender will know about it until the tax bill arrives.

So what happens when there's a shortage?

Usually, when they pay your tax bill for you using your escrow funds, your lender will also cover the amount that's short. But you'll have to pay them back, and this is where the tricky part comes in.

In order to pay back the shortage, your lender will need to increase the escrow portion of your mortgage payment. That part probably seems obvious.

But what doesn't seem obvious is how much they'll have to increase it by. First, they'll have to increase it to cover the new estimate. Then, they'll also need to increase it by even more in order to cover the amount you were short.

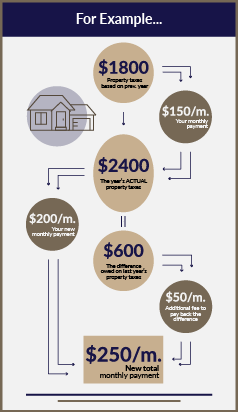

Here's an example: Let's say your property taxes last year were $1800, so this year, your lender had you pay $150 per month into your escrow account. But this year, when your home was reassessed, they ended up being $2400, so you had a shortfall of $600.

Because next year's property tax estimate is based on last year, your new property tax estimate is $2400, which means your monthly payment is now $200, which is a $50 increase over last year.

But you still need to pay back the $600 you were short last year. In order to do that over the next 12 months, your lender will need to increase your monthly payment by another $50 ($600 ÷ 12 months = $50/month).

So now next year's TOTAL payment, for both the new tax amount and your shortfall, is $250/month. That's $100 dollars higher than it was. That much of a jump can be a shock for some homeowners.

However, you do have some options. For starters, you could try to contest the bill. How much time you have to do this depends on where you live, and there may be other limits in place. It will also typically require a lot of work.

There are also options in how you work out the repayment to your lender.

If you have the extra money, you may just want to pay the shortage up front, rather than paying it back over 12 months. In our scenario, that means you'd pay $600 up front and your monthly escrow charges would only be $200/month.

Another repayment option is to pay part of the shortfall up front and the rest over the next 12 months. This also reduces your monthly mortgage bill, though not by quite as much as a full upfront payment.

You might even be able to pay the shortage back over 24 months, if that's something your lender allows.

Overages

On the other end of the spectrum, you could experience an overage, which occurs when your property taxes drop.

Compared to some of the others, this one might not really seem like a problem, because it means you get money back, right?

While it's true an overage means you may get money back from your lender, that's only if the overage is above a certain amount. If it's below it, they'll likely just keep it in your escrow account to offset any future increases that might happen.

But where the real problem lies is that an overage means you've possibly been missing out on the ability to have that money earn interest.

In most states, escrow accounts won't earn any interest. That's because the Real Estate Settlement Procedures Act (RESPA), a set of federal laws that regulate escrow, doesn't require it.

So, if you live in one of the 35 states that hasn't implemented its own set of laws requiring interest on escrow accounts, you could potentially lose out on thousands of dollars that could be earning significant interest somewhere else.

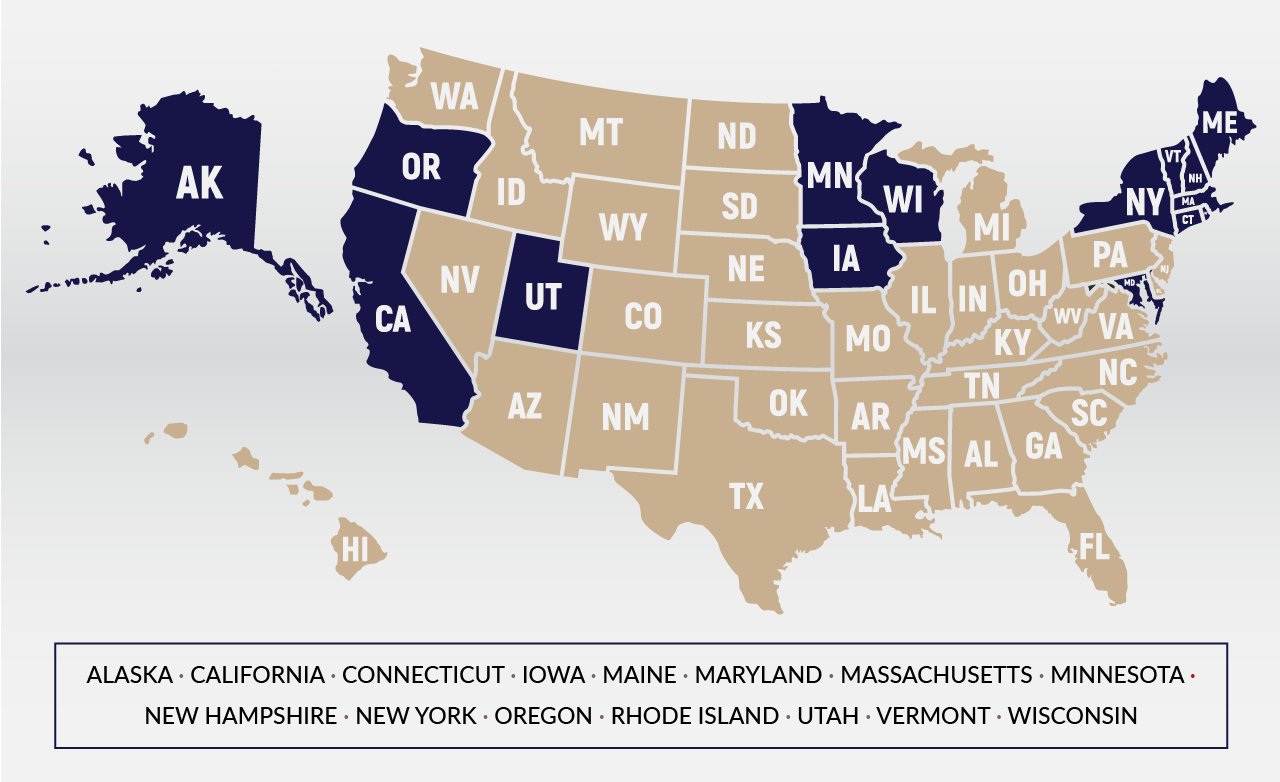

However, if you live in one of the following states, you can earn interest on your escrow account, which somewhat reduces the missed financial opportunity an overage represents:

Late Payments & Other Account Issues

Though we've already established that it's pretty rare, late payments do sometimes happen. It can be a big hassle, but there is a silver lining.

RESPA requires lenders to make your tax and insurance payments on time. So, if they make your payment late or miss one all together, you won't be on the hook for the late fees. By law, your lender is the one who has to pay them.

Another rare possibility can occur if or when your escrow company goes broke or out of business. Most likely they will be insured by the FDIC, but it may take some time to untangle things, which could affect your payments.

How Escrow Works: Paying Your Property Taxes & Homeowners Insurance

When and how often your property taxes are due depends on the county you live in. For most counties, they are usually due either once or twice a year. As for your homeowners insurance premium, it's also most likely due annually.

However, since you're essentially making monthly payments for these into an escrow account, how do they actually get paid once their due dates come around?

Since you have an escrow account, your lender was most likely appointed as your designated paying agent during closing. As your designated agent, they are in charge of making the actual tax and insurance payments on your behalf.

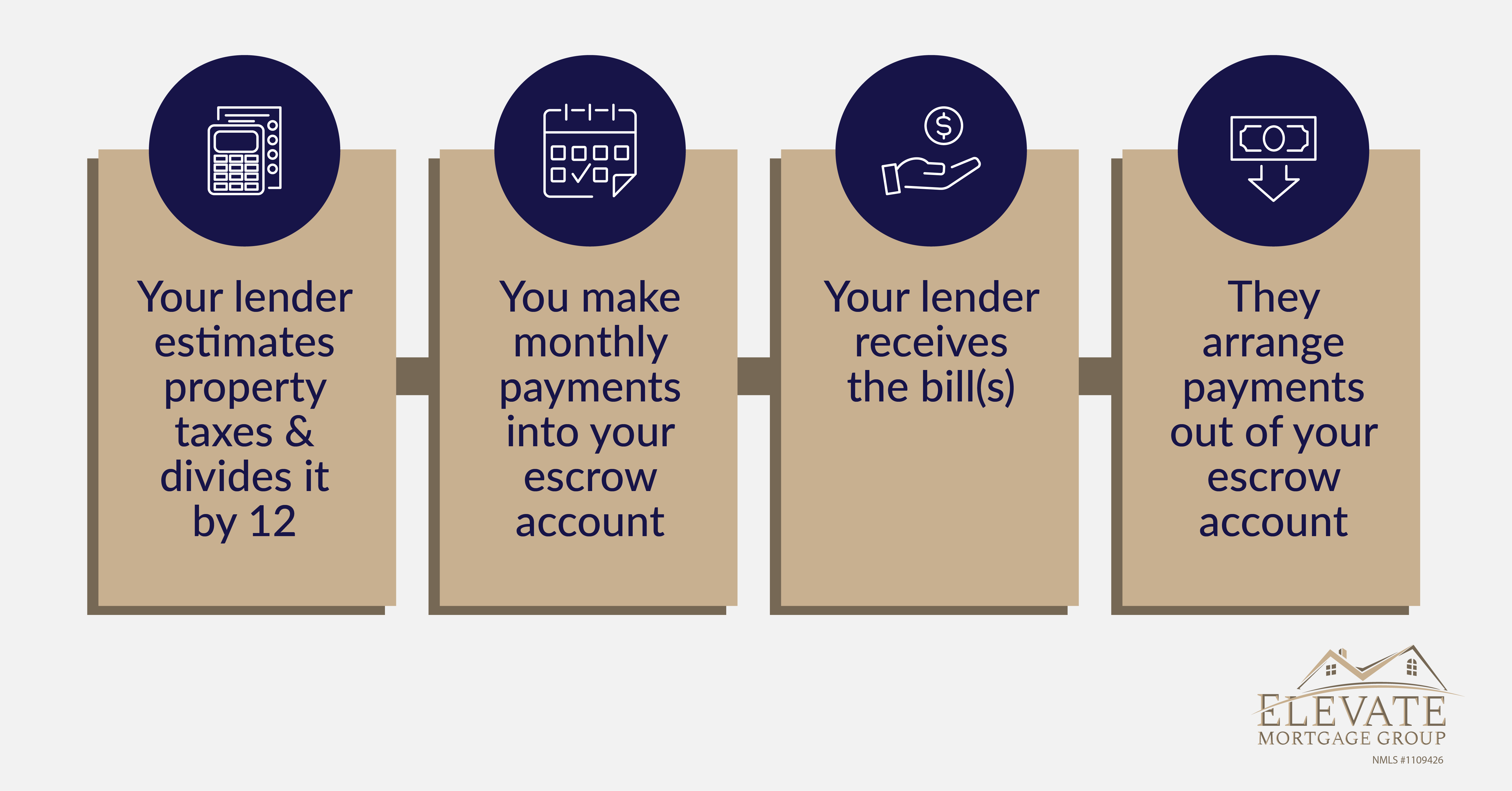

To start the process, each year your lender estimates your property taxes based on the assessed value of your home. And, while they aren't in charge of reviewing or updating your homeowners insurance policy, they will also take a look at what that's expected to be.

Once they have these two numbers, they will add them together and divide by 12; this gets added to your monthly mortgage payment and is the portion that will go into escrow.

When it's time for your taxes to be paid, the county will send your lender a bill, which will include any early payment options and the actual due date. At this point your lender will arrange the payment and have the money taken out of your escrow account.

When your homeowners insurance premium is due, it follows a similar process where your lender arranges the payment from your escrow account.

Want More Information about Escrow?

We hope we've thoroughly answered your question, "What is escrow?" However, if you'd like more information, or want to talk to us about the details, don't hesitate to give one of our experienced loan officers a call at (888) 935-3828.

At Elevate Mortgage, it's our goal to be a resource you can rely on for all things related to home loans and mortgages, so if you'd like help sorting through any of this information, we're happy to help. After all, we want the loan process to be as simple and clear as possible.